Middle Meddling: Management and ethics

Blog Goal setting is often a subject of discussion about behavioral ethics and internal programs. We’ve seen in recent cases such as at Wells Fargo and Volkswagen how cheating and lying become the norm when performance goals are not reasonably achievable. Recent evidence in a paper by Niki den Nieuwenboer, João da Cunha, and ES collaborator Linda Treviño shows the internal dynamics and processes that lead directly to cheating behaviors.

Goal setting is often a subject of discussion about behavioral ethics and internal programs. We’ve seen in recent cases such as at Wells Fargo and Volkswagen how cheating and lying become the norm when performance goals are not reasonably achievable. Recent evidence in a paper by Niki den Nieuwenboer, João da Cunha, and ES collaborator Linda Treviño shows the internal dynamics and processes that lead directly to cheating behaviors.

The researchers, one of which was embedded inside the company, observed managers and sales staff over 15 months at a large (10,000 employees) telecommunications company. The company had established goals for its desk sales teams designed to motivate productivity, including a target for sales as well as sales-related work, such as making cold calls to customers, and gathering information about potential customers, among other planning activities.

Azish Filabi Presents on Measuring Corporate Culture at the 2018 OECD Conference

Blog Last week, the Organisation for Economic Co-operation and Development (OECD) had its annual Anti-Corruption and Integrity Forum at their headquarters in Paris. Entitled Planet Integrity: Building a Fairer Society, over 2,000 attendees discussed how integrity plays a role in improving economic inequality, enhances the benefits of public policies and government programs, and more broadly equalizes the gains of globalization.

Last week, the Organisation for Economic Co-operation and Development (OECD) had its annual Anti-Corruption and Integrity Forum at their headquarters in Paris. Entitled Planet Integrity: Building a Fairer Society, over 2,000 attendees discussed how integrity plays a role in improving economic inequality, enhances the benefits of public policies and government programs, and more broadly equalizes the gains of globalization.

Ethical Systems won one of the OECD Research Edge competition awards. The paper, co-written by Caterina Bulgarella and myself, provided the summary of our culture assessment framework, which demystifies an often complex organizational issue: how to define and measure ethical culture.

COMMENTARY: Safeguarding financial firm cultures: five focus factors for directors

Blog Board members have the difficult job of overseeing the success of a firm without getting involved in day-to-day management or operations. Increasingly, they are expected to understand compliance and other risks of misbehavior, particularly as those risks have been shown to impact financial performance.

Board members have the difficult job of overseeing the success of a firm without getting involved in day-to-day management or operations. Increasingly, they are expected to understand compliance and other risks of misbehavior, particularly as those risks have been shown to impact financial performance.

In a commentary I co-wrote with Mike Silva, Partner and Chair of the Financial Services Regulatory practice at DLA Piper, we emphasize the role of corporate culture in promoting good behavior as well as financial stability.

The Echo Effect of the Bear Stearns Collapse: The Loss of Trust

Blog In the wake of the 10 year anniversary of the collapse of Bear Stearns, we’ve been considering the long-term impact of the financial crisis and its reverberations on Main Street today. For many, there’s been a seemingly permanent shift in how they view Wall Street, including its purpose and the people who have been charged with managing their hard earned money. While the economy may have recovered since the Great Recession, there are numerous former investors whose levels of trust in financial companies have not.

In the wake of the 10 year anniversary of the collapse of Bear Stearns, we’ve been considering the long-term impact of the financial crisis and its reverberations on Main Street today. For many, there’s been a seemingly permanent shift in how they view Wall Street, including its purpose and the people who have been charged with managing their hard earned money. While the economy may have recovered since the Great Recession, there are numerous former investors whose levels of trust in financial companies have not.

In a recent piece in The Wall Street Journal, writer Jason Zweig spotlights how the collapse of Bear Stearns wreaked havoc on the sense of fairness among everyday investors and “what psychologists call ‘belief in a just world,’ the notion that, on average, we get what we deserve.”

Bank Culture Reform & Behavioral Science Event April 9

Blog Ethical Systems is partnering with Thomson Reuters Legal Managed Services, Regulatory Intelligence, and Starling to put on a panel event on Bank Culture Reform & Behavioral Science.

Ethical Systems is partnering with Thomson Reuters Legal Managed Services, Regulatory Intelligence, and Starling to put on a panel event on Bank Culture Reform & Behavioral Science.

Location:

Thomson Reuters

3 Times Square

30th Floor

New York, NY 10036

Date and Time:

Monday, April 9th

8:30 a.m. – 12:00 p.m. ET

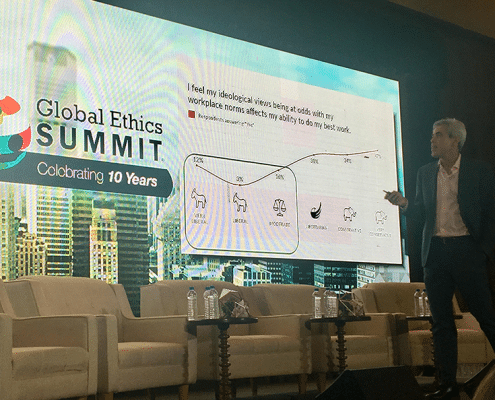

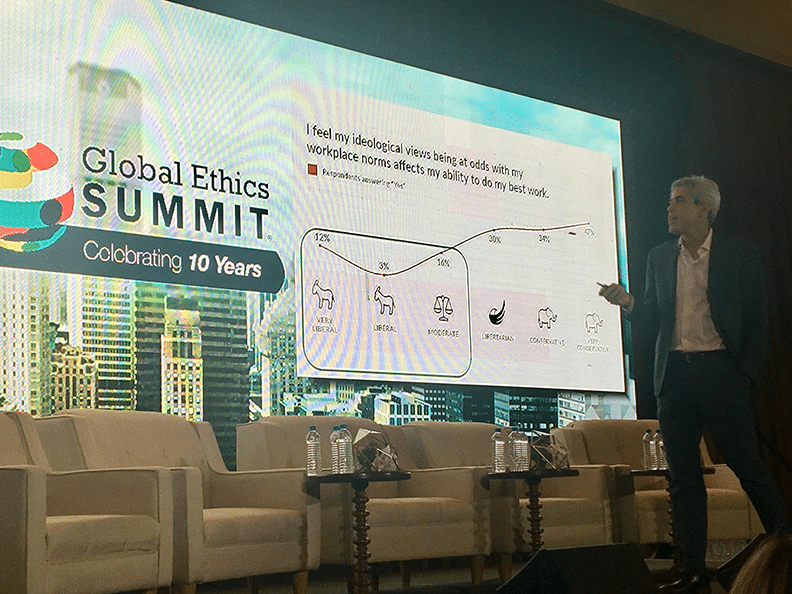

Jon Haidt Presents Keynote on “Maintaining Ethical Culture” at Global Ethics Summit 2018

Blog In today's polarized political climate, it is even more important to know how to engage in constructive dialogue in order to advance mutual business interests and perpetuate a sustainable organizational culture of ethics and respect.

In today's polarized political climate, it is even more important to know how to engage in constructive dialogue in order to advance mutual business interests and perpetuate a sustainable organizational culture of ethics and respect.

Addressing this head on, Ethical Systems co-founder Jonathan Haidt delivered a mid-day keynote entitled Maintaining Ethical Culture in a Political Whirlwind on day 1 at Ethisphere's Global Ethics Summit 2018.

Featured Expert Mira Dewji, Attorney, Adjunct Professor and Strategic Advisor

BlogFeatured Expert Mira Dewji, Attorney, Adjunct Professor and Strategic Advisor

What are your current areas of work and instruction?

What are your current areas of work and instruction?

I’m a practicing attorney in the social impact sector and an Adjunct Professor in the Business and Society Program at NYU’s Stern School of Business. I provide legal and strategic advice to high-impact social enterprises, small businesses, foundations, and nonprofits whose means and ends align with my values. I see the law as a tool with which I can craft, protect and facilitate my clients’ social objectives. Perhaps because my clients are organizations and not individuals, my interest in business ethics is at the organizational level. When social impact is framed as ethics, it adopts a powerful lexicon. A business or industry’s responsibility becomes more than merely a conversation around compliance with law or private sector benevolence. Social impact encompasses the duties and relationship between an organization and the environment that facilitates its existence.

From this perspective, it is not sufficient for an organization to maintain certain ethical practices with key stakeholders such as employees, customers, and partners. Designing systems that define and foster company values such as honesty, integrity, transparency, accountability, trust, and ethical leadership are essential. But organizations also participate in shaping societal values and outcomes, and the extent to which a company embraces that responsibility is a reflection of its ethics.

NY Fed Offers New Insights for Financial Services Firms

Blog There are two new resources on the Governance and Culture Reform site of the Federal Reserve Bank of NY that highlight the regulatory trends with respect to managing culture in financial services firms.

There are two new resources on the Governance and Culture Reform site of the Federal Reserve Bank of NY that highlight the regulatory trends with respect to managing culture in financial services firms.

The first is a transcript from an event at Thomson Reuters on February 7, 2018, which was a moderated discussion among Bill Dudley (President of the NY Fed), Bill Rhodes (WR Rhodes Global Advisors), and Ellen Alemany (Chairwoman and CEO of CIT Group), moderated by Rob Cox (Reuters News). The panelists covered a wide array of matters relating to the topic of Banking Culture: Still room for reform?

Dudley highlighted that while some progress has been made, there’s still much room for improvement. For example, the NY Fed has proposed a banking registry to keep track of whether employees have left their jobs for reasons of fraud or other misconduct. This would address the so called “rolling bad apples” problem, whereby companies may inadvertently hire a rogue employee of another firm because employment law discourages employers from sharing potentially derogatory information about former employees. He mentions that the U.K. has perhaps made more progress on this matter, having already established a similar registry.

Featured Expert Pat Harned, CEO of the Ethics and Compliance Initiative

BlogFeatured Business Ethics and Leadership Expert Pat Harned, CEO of the Ethics and Compliance Initiative

For many years, ECI has been a leader in providing research, resources and communities of practice for business ethics leaders. What do you see on the horizon for the organization as it helps companies elevate their E&C programs?

It has been an honor for us to be able to work alongside some of the finest practitioners who are dedicated to establishing and maintaining a high standard of integrity in their organizations. We intend to continue providing these practitioners new insights from research, and new benchmarks on the drivers of ethical cultures. We will also be launching even more ways for professionals to exchange ideas and to advance best practice. ECI is also working with a group of practitioners to develop a maturity model of E&C programs, based on our recent Blue Ribbon Panel report on High Quality Ethics & Compliance Programs. Our expectation is that this new resource will help companies to further assess and improve their programs.

Under Pressure: Wells Fargo, Misconduct, Leadership and Culture

Blog Consistent with our mission to bring timely and relevant research to the business ethics community, Ethical Systems has just published a new electronic resource: Under Pressure: Wells Fargo, Misconduct, Leadership and Culture [updated May 2018 to include a new Executive Summary and further details about the case]

Consistent with our mission to bring timely and relevant research to the business ethics community, Ethical Systems has just published a new electronic resource: Under Pressure: Wells Fargo, Misconduct, Leadership and Culture [updated May 2018 to include a new Executive Summary and further details about the case]

This case study, created by Bharathy Premachandra, our 2017 Bryan Turner Intern in Business Ethics, with Azish Filabi, Executive Director of Ethical Systems, spotlights the lessons learned from the recent scandal at Wells Fargo around false accounts, inflated sales targets and misguided directives from bank executives.