New paradigms to tackle age-old governance problems

Blog

And Now Ethics 2.0: An Argument For More Self-Governance

Blog In a new article in Forbes, ES advisory board member Carsten Tams offers advice on designing ethics and compliance programs that serve to both strengthen adherence to regulatory guidelines and provide employees with a broader measure of moral agency.

In a new article in Forbes, ES advisory board member Carsten Tams offers advice on designing ethics and compliance programs that serve to both strengthen adherence to regulatory guidelines and provide employees with a broader measure of moral agency.

The intention behind an action is central to the distinction between "compliance" and "ethical behavior." Compliance is simply behavior in accordance with someone else’s requirements in order to gain rewards or avoid punishment. When people act ethically, they are self-governed. Ethical behavior is prosocial behavior for its own sake. People engage in it for no other reason than that they view it as the right thing to do. As such, ethical behavior is intrinsically motivated.

Long Term Thinking Means Ending Short-Term Reports

Blog The chorus to end quarterly corporate reporting recently gained two prominent voices from the financial world. In a recent article in Bloomberg, Jamie Dimon, CEO of JP Morgan Chase, and Warren Buffett, the Chairman of Berkshire-Hathaway, advised companies to do away with their emphasis on quarterly earnings reports, arguing that it motivates misconduct and shifts the focus from sustained growth and stability to immediate profits and performance.

The chorus to end quarterly corporate reporting recently gained two prominent voices from the financial world. In a recent article in Bloomberg, Jamie Dimon, CEO of JP Morgan Chase, and Warren Buffett, the Chairman of Berkshire-Hathaway, advised companies to do away with their emphasis on quarterly earnings reports, arguing that it motivates misconduct and shifts the focus from sustained growth and stability to immediate profits and performance.

Inquiry into Australia’s Banking and Finance Industry

BlogBy Dennis Gentilin, founding director of Human Systems Advisory and an adjunct fellow at Macquarie University. He was employed at the National Australia Bank for 16 years.

As readers of this blog may know, there is currently an inquiry into the banking and finance industry in Australia. Prime Minister Malcolm Turnbull announced The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry in November 2017. Former High Court Judge Kenneth Hayne AC was appointed as the commissioner shortly after the announcement and public hearings commenced earlier this year.

As readers of this blog may know, there is currently an inquiry into the banking and finance industry in Australia. Prime Minister Malcolm Turnbull announced The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry in November 2017. Former High Court Judge Kenneth Hayne AC was appointed as the commissioner shortly after the announcement and public hearings commenced earlier this year.

FCA UK Culture Conference Event Summary & Next Steps

Blog At the recent Financial Conduct Authority March 2018 meeting in London, Ethical Systems Executive Director Azish Filabi and collaborator Celia Moore participated in panels featuring fellow experts discussing current, pressing issues in regards to culture, regulation, ethics and compliance in the financial sector.

At the recent Financial Conduct Authority March 2018 meeting in London, Ethical Systems Executive Director Azish Filabi and collaborator Celia Moore participated in panels featuring fellow experts discussing current, pressing issues in regards to culture, regulation, ethics and compliance in the financial sector.

Regulating for Ethical Culture in Behavioral Science & Policy

Blog Ethical Systems partnered with The Behavioral Science and Policy Association (BSPA) to put on our 2016 conference “Ethics By Design.” One byproduct of the event- in addition to knowledge transfer and widespread press coverage- was the extension of our conference theme in an issue of BSPA’s interdisciplinary journal Behavioral Science & Policy (published twice yearly with the Brookings Institution) with a focus on applying behavioral science strategies and strengthening ethical culture.

Ethical Systems partnered with The Behavioral Science and Policy Association (BSPA) to put on our 2016 conference “Ethics By Design.” One byproduct of the event- in addition to knowledge transfer and widespread press coverage- was the extension of our conference theme in an issue of BSPA’s interdisciplinary journal Behavioral Science & Policy (published twice yearly with the Brookings Institution) with a focus on applying behavioral science strategies and strengthening ethical culture.

In a "spotlight on ethics," co-edited by Jon Haidt and Azish Filabi, the Journal's issue has just been released with three review articles on how behavioral insights can guide policies and interventions meant to promote ethical behavior. The three pieces include: “Treating ethics as a design problem,” by ES collab Nicholas Epley alongside David Tannenbaum, “Using behavioral ethics to curb corruption,” by friend of ES Yuval Feldman and the essay we summarize below, “Regulating for ethical culture,” by ES collab Linda Trevino, co-founder Jonathan Haidt and Executive Director Azish Filabi.

Tribes, vibes and hives: improving diversity through science

BlogThis is an article by Laura Smart cross-posted from Insight, the opinion and analysis page of the UK's Financial Conduct Authority (FCA). Original post.

Behavioural science can tell us a lot about how humans are hardwired, and where efforts to improve diversity will be best spent.

Behavioural science can tell us a lot about how humans are hardwired, and where efforts to improve diversity will be best spent.

In 1951, Solomon Asch carried out an experiment which was to become one of the most widely known and pivotal findings in psychology.

Wanting to investigate how people were influenced by others when making decisions, he recruited students to judge the relative lengths of lines on a piece of paper. The catch was that each student was put into a group which, unknown to them, was made up of actors who had been instructed to give the same, obviously incorrect, answer some of the time.

The videos show the conflict faced by the participants when they come to give their verdict after listening to others ahead of them denying what is in front of their eyes. All in all, 70% of participants gave the same answer as the others at least some of the time - despite knowing that it was wrong.

There lies a perfect illustration of the dangers of conformity and groupthink - dangers that employers are increasingly trying to tackle, in part, through increasing diversity.

In financial services, considerable effort and resources have been put into diversity and inclusion programmes, including mandating training, introducing targets and changing recruitment processes. But senior managers often find it hard to know which efforts are most effective and where resources would be best spent.

Fortunately, behavioural science can tell us a lot about this. And some of the findings might come as a surprise.

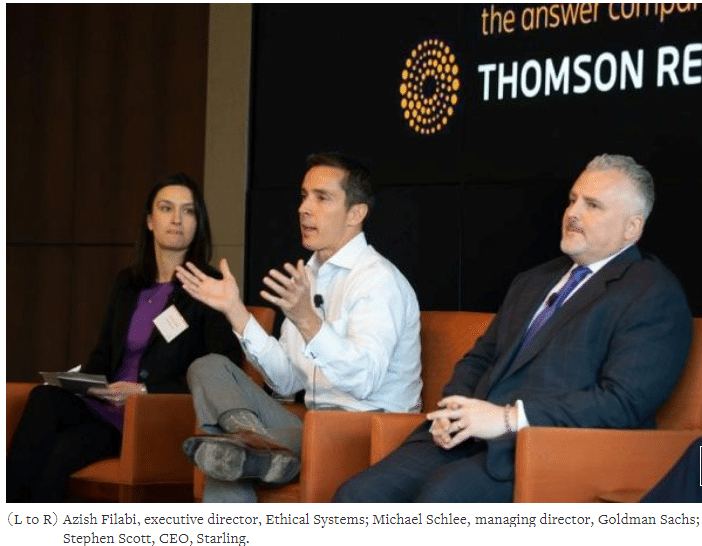

A Behavioral Science Approach to Bank Culture, with Azish Filabi

Blog At a recent Thomson Reuters forum in New York on culture and behavioral science in the banking industry, Ethical Systems' Executive Director Azish Filabi joined a panel with fellow experts to discuss how research and data helps shape ethics and culture.

At a recent Thomson Reuters forum in New York on culture and behavioral science in the banking industry, Ethical Systems' Executive Director Azish Filabi joined a panel with fellow experts to discuss how research and data helps shape ethics and culture.

We invite you to read a piece on Reuters on the event featuring the following takeaways we share in this blog. Video from the event is also embedded.

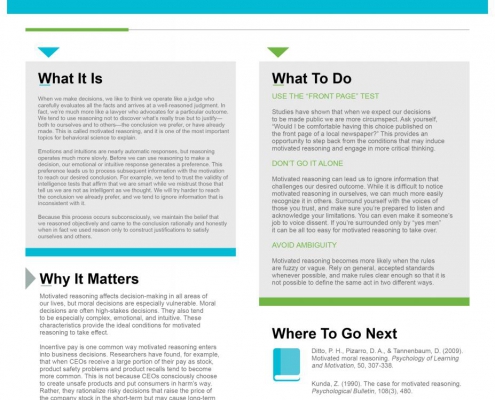

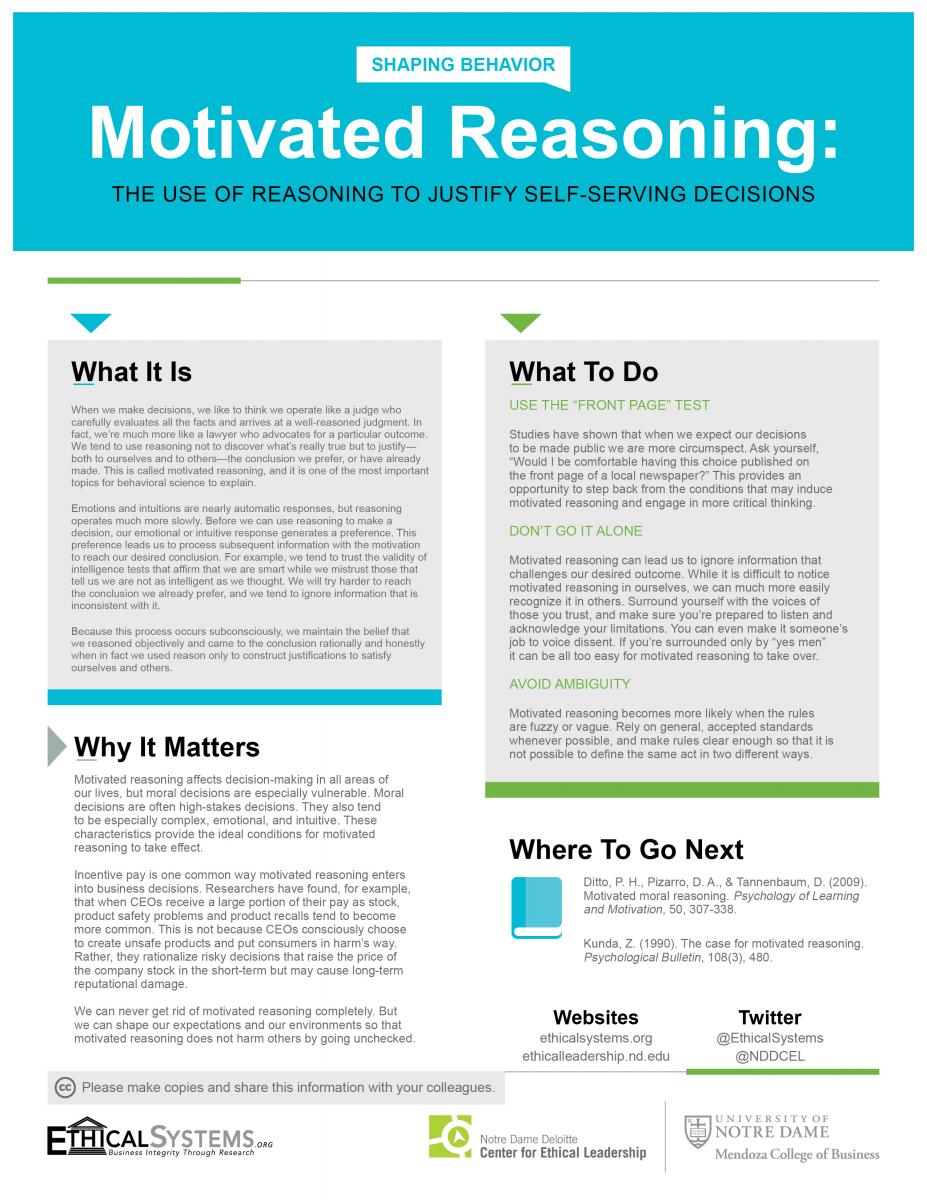

New Behavioral Science One Sheet: Motivated Reasoning

Blog Our newest topic is "Motivated Reasoning" explaining how the process by which we make decisions is less like a judge who carefully evaluates all the facts and arrives at a well-reasoned judgment and more like a lawyer who advocates for a particular outcome.

Our newest topic is "Motivated Reasoning" explaining how the process by which we make decisions is less like a judge who carefully evaluates all the facts and arrives at a well-reasoned judgment and more like a lawyer who advocates for a particular outcome.

Creating and Maintaining a Healthy Corporate Culture: RANE podcast with Azish Filabi

Blog In this podcast, (Risk Assessment Network + Exchange) RANE’s Serina Vash sits down with Azish Filabi, Executive Director, Ethical Systems, to discuss what drives a healthy corporate culture and best practices for creating and maintaining that culture. Through research and collaboration with the best academics in the field, Azish dedicates her time to helping businesses assess and promote ethical behavior and culture in their organizations.

In this podcast, (Risk Assessment Network + Exchange) RANE’s Serina Vash sits down with Azish Filabi, Executive Director, Ethical Systems, to discuss what drives a healthy corporate culture and best practices for creating and maintaining that culture. Through research and collaboration with the best academics in the field, Azish dedicates her time to helping businesses assess and promote ethical behavior and culture in their organizations.