Tag Archive for: compliance

Is Political Ideology a Compliance and Ethics Risk?

Blog Cross posted with permission from ES Collaborator Jeffrey Kaplan's Conflict of Interest blog

Cross posted with permission from ES Collaborator Jeffrey Kaplan's Conflict of Interest blog

In a post last week on the Harvard Law School Forum on Corporate Governance and Financial Regulation, Danling Jiang, Associate Professor of Finance at Florida State University, summarizes a recent article she authored with Irena Hutton, Associate Professor of Finance at Florida State University; and Alok Kumar, Professor of Finance at the University of Miami: “Political Values, Culture, and Corporate Litigation,” which was published in the latest issue of Management Science and which “examine[s] whether the political culture of a firm defines its ethical and legal boundaries as observed by the propensity for corporate misconduct.”

In a post last week on the Harvard Law School Forum on Corporate Governance and Financial Regulation, Danling Jiang, Associate Professor of Finance at Florida State University said of recent research, “Using one of the largest samples of litigation data to date, [they] show that firms with Republican culture are more likely to be the subject of civil rights, labor, and environmental litigation than Democratic firms, consistent with the Democratic ideology that emphasizes equal rights, labor rights, and environmental protection. However, firms with Democratic culture are more likely to be the subject of litigation related to securities fraud and intellectual property rights violations than Republican firms whose Party ideology stresses self-reliance, property rights, market discipline, and limited government regulation.”

This is interesting – if not necessarily surprising – stuff, and particularly so in an election year. But does it bear on the work of C&E professionals? And does it have anything to do with conflicts of interest?

Point-of-Risk Compliance

BlogThis piece is cross posted from ES collaborator Jeffrey Kaplan's "Conflicts of Interest" blog with permission.

Marketers have long known that “point-of-sale” display of products can be a powerful advertising tool. But can its logic be put to work for promoting compliance and ethics?

I was recently asked by a client to fill out a vendor information form and noticed that in addition to seeking information from vendors the form required the employee proposing the hiring to certify that any conflict of interest involving the vendor had been disclosed and okayed by management and the C&E officer. While I know that many companies have some form of COI certifications (see prior posts), I can’t recall having seen one on a vendor information form of this sort before – even though the common sense of such a “point-of-risk” compliance approach seems pretty obvious. Indeed, it is hard to think of any reason why a company wouldn’t do this.

Bad Apples, Bad Barrels or Bad Barrel Makers?

Blog The prominence of compliance in organizations continues to rise. Recently, the US Department of Justice (DOJ) named Ms. Hui Chen as its Compliance Counsel- a much anticipated new role which many have applauded as a step forward for addressing the criticism that the DOJ doesn’t appropriately credit companies who implement effective compliance programs.

The prominence of compliance in organizations continues to rise. Recently, the US Department of Justice (DOJ) named Ms. Hui Chen as its Compliance Counsel- a much anticipated new role which many have applauded as a step forward for addressing the criticism that the DOJ doesn’t appropriately credit companies who implement effective compliance programs.

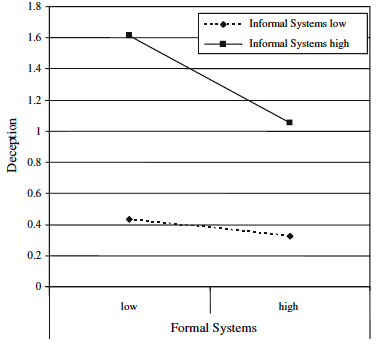

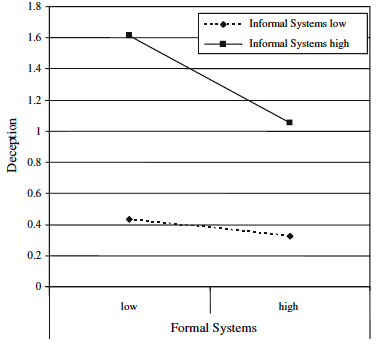

Ms. Chen comes well prepared from a background in both corporate compliance and prosecution, which she will likely lean heavily upon when tackling the difficult task of helping prosecutors recognize whether an incident is symptomatic of an unethical corporate culture or the result of a rogue employee. This is the distinction that has challenged social psychologists for decades: is it the individual or the system that is to blame?

Did You Get the Memo? Confronting Corporate Wrongdoing

Blog After the financial crisis of 2008 and the current, ongoing instances of large fines levied against banks and other financial companies, many people continually bemoan why penalties have not also included jail time and prosecution of executives who have behaved unethically. The message has finally reached the highest levels of government and change is on the horizon.

After the financial crisis of 2008 and the current, ongoing instances of large fines levied against banks and other financial companies, many people continually bemoan why penalties have not also included jail time and prosecution of executives who have behaved unethically. The message has finally reached the highest levels of government and change is on the horizon.

In a speech at NYU Law last week, hosted by the school's Program on Corporate Compliance and Enforcement, Deputy Attorney General Sally Quillian Yates presented the memo covering a new Department of Justice initiative designed to fight corporate fraud and other misconduct by going after individuals who perpetrated the wrongdoing. In addition to punitive actions against an organization (what many see as a macro-level punishment that does little to deter misconduct on the micro, or personal, level), the DOJ will now turn its considerable resources to affecting change at the source, i.e. those that engage in personal malfeasance under the guise of doing their job.

A Dream Remit For the New DOJ Compliance Counsel

Blog Designing ethical systems is about having the right policies and programs in place- as well as the right people. Recently, the Department of Justice took a needed step forward by retaining a new full-time expert in compliance programs for their prosecution team. ES collaborator Jeffrey Kaplan, of Kaplan & Walker, LLP explains in a new Conflicts of Interest blog entry, cross posted below, how the new hire will allow the government to advance not only their understanding of how to strengthen and evaluate organizational compliance programs, but how the DOJ can leverage this position to put forth an agenda that highlights positive actions in the field.

Designing ethical systems is about having the right policies and programs in place- as well as the right people. Recently, the Department of Justice took a needed step forward by retaining a new full-time expert in compliance programs for their prosecution team. ES collaborator Jeffrey Kaplan, of Kaplan & Walker, LLP explains in a new Conflicts of Interest blog entry, cross posted below, how the new hire will allow the government to advance not only their understanding of how to strengthen and evaluate organizational compliance programs, but how the DOJ can leverage this position to put forth an agenda that highlights positive actions in the field.

Ethics and Wall Street: Reactions and Reform

Blog In the wake of the financial crisis of 2008, many thought ethics reform would come quickly to Wall Street. New laws did come, in the USA and UK. But is the culture changing for the better? A new report (The Street, The Bull and The Crisis: A Survey of the US & UK Financial Services Industry) suggests that there has been little change in the last three years, and there may be some worrying trends among younger employees.

In the wake of the financial crisis of 2008, many thought ethics reform would come quickly to Wall Street. New laws did come, in the USA and UK. But is the culture changing for the better? A new report (The Street, The Bull and The Crisis: A Survey of the US & UK Financial Services Industry) suggests that there has been little change in the last three years, and there may be some worrying trends among younger employees.

You can find a quick summary of the report in this article by NPR. To go beyond the summary, we asked our expert suite of collaborators for their reactions.

The bottom line is that better ethical behavior will come when legal reforms lead to, or are supplemented by, changes in the culture and norms of the financial industry. As Tenbrunsel explains, "Just more regulation without addressing the individual, organizational and industry-level factors probably isn't going to have a very significant impact." Addressing all of those factors simultaneously is our goal at Ethical Systems.

Ethics and Compliance Trends: Interview with Ellen Hunt of AARP

Blog Part of the mission of Ethical Systems is to enhance the work of practitioners and experts in the ethics and compliance field, as they are on the front lines of helping businesses transform their cultures and their employees act more ethically.

Part of the mission of Ethical Systems is to enhance the work of practitioners and experts in the ethics and compliance field, as they are on the front lines of helping businesses transform their cultures and their employees act more ethically.

In a recent interview with Ellen Hunt, Ethics & Compliance Program Director at AARP, she outlined current trends in the Ethics & Compliance (E&C) field as well as the most important steps businesses can take to encourage ethical behavior among organizations of all types and sizes. AARP is a nonprofit, nonpartisan organization, with a membership of nearly 38 million.

The Ethics ‘‘Fix’’: When Formal Systems Make a Difference

Blog