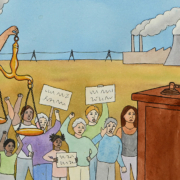

Insurance Companies Can Help Phase Out the Fossil-Fuel Industry

In this episode of the Breaking the Fever podcast, the second in our miniseries on climate finance, we speak with Peter Bosshard and Elana Sulakshana about the insurance sector’s role in maintaining status-quo climate policies, and what insurers can do to halt the development of more fossil-fuel infrastructure.

We discuss:

- What might happen if insurers didn’t provide insurance for new gas and oil pipelines

- The near-absolute confidentiality of who is insuring what

- The role coal plants in the EU have in premature deaths

- The hypocrisy of insurance companies’ stated aims and actions

- The uneven geographical distribution of insurance companies that want to phase out links to coal and other climate risks

- The touting of investments in green tech by insurance companies to divert attention away from investments in fossil fuel

- How most major insurance companies in Europe stopped insuring coal mining

- How the insurance industry is organized around climate issues

- The promise of insurance companies pressuring corporations on climate with share-holder resolutions

- How US insurance companies lag behind peers in Europe, Australia

- The role of insurance brokers

Peter Bosshard is the director of the Finance Program at the Sunrise Project, the aim of which is to grow social movements to drive the transition from fossil fuels to renewable energy as fast as possible. He coordinates international campaigns to accelerate the transition of the insurance industry and other investors from fossil fuels to clean energy.

Elana Sulakshana leads Rainforest Action Network’s campaign to stop the U.S. insurance industry from driving the climate crisis. She has been active in the climate justice movement for the last eight years, most recently organizing for just and equitable climate policy in Washington State, fighting fracking in the U.K., and campaigning for universities to divest from fossil fuels and reinvest in communities.